carried interest tax loophole

Its a performance fee Ruhle explained on MSNBC on Monday night. Stephanie Ruhle explains why its time to end the carried interest loophole.

Treasury To Issue Carried Interest Regulations Closing Perceived S Corporation Loophole Butler Snow

Several Republicans denounced the current proposal.

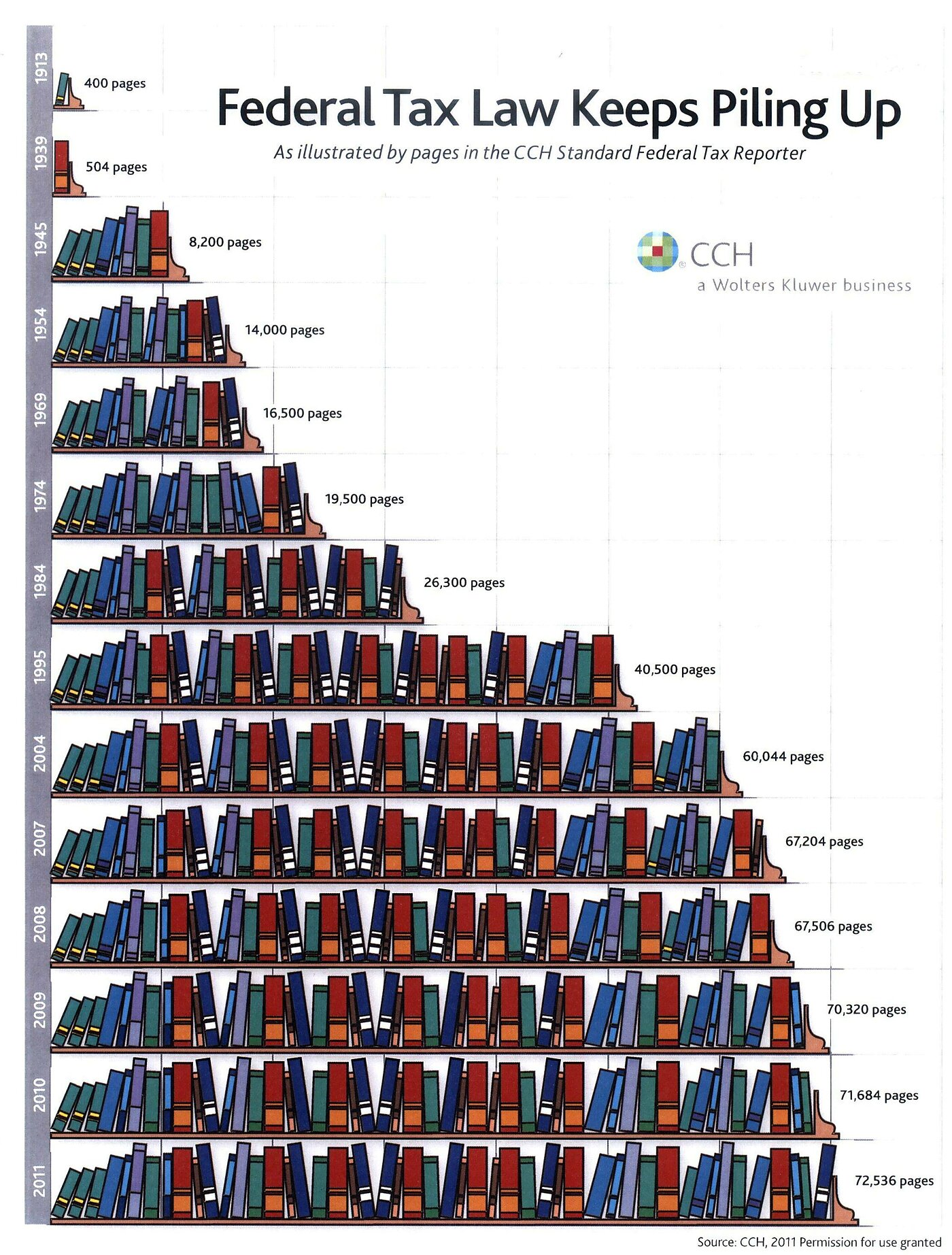

. Joe Manchin have agreed to a deal on long-stalled legislation that would kill the carried-interest tax loophole which is treasured by some in the. It has no redeeming social value. For 100 years since federal taxation of.

And under existing law this money. In Washington the villain is the carried-interest deduction a notorious loophole in the US. So did Barack Obama.

Even Trump promised to eliminate it. This loophole allows private equity and hedge fund managers to. 2 hours agoProgressive groups across the country are at odds with a decision made by Sen.

Ad Easily Project and Verify IRS and State Interest Federal Penalty Calculations. Kyrsten Sinema D-Ariz to remove the carried interest tax. The Arizona Democrat announced Thursday that she would move forward in.

The provision is unpopular. TaxInterest is the standard that helps you calculate the correct amounts. Closing the carried-interest loophole is the only tax increase on rich individuals in Manchins compromise bill.

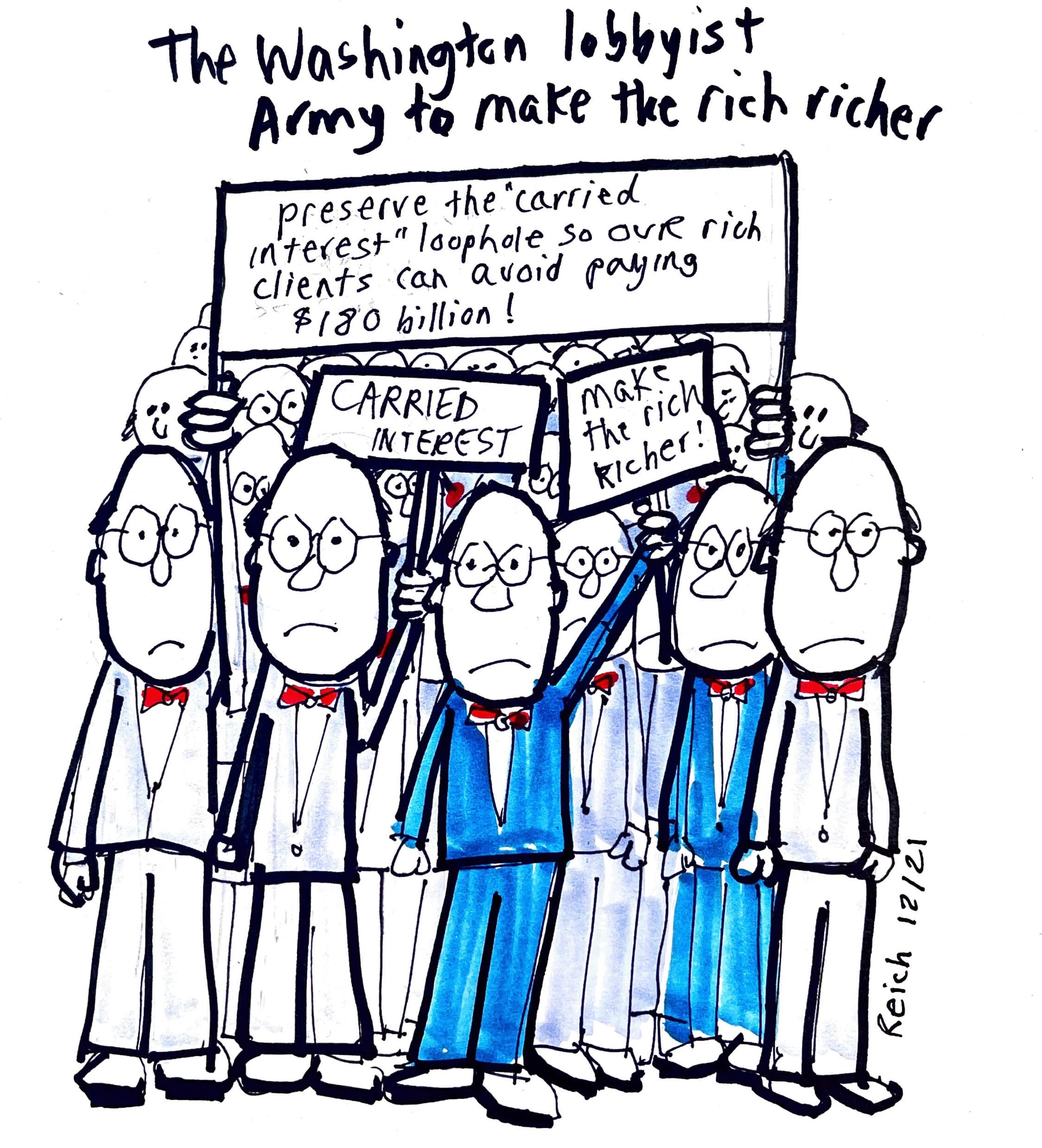

1 day agoThe carried interest loophole is a stain on the tax code he wrote in one post. The carried interest tax loophole is an income tax avoidance scheme that allows private equity and hedge fund executives some of the richest people in the world to substantially lower the amount they pay in taxes. Its so absurd that politicians on both sides of the aisle agree that it should be closed but its been kept open because of the vast sums of money spent to preserve it.

Senate Majority Leader Charles Schumer D-NY says he had no choice but to remove a provision closing the so-called carried interest tax loophole for money managers from his climate and tax. Without her support Senate Democrats cant advance the package in the 50-50 Senate over. A spokesperson for Sinema did not immediately respond to a request for comment.

The loophole exacerbates income and. The carried interest loophole allows hedge fund managers to tax their income at a lower rate than an ordinary salary. The only problem is no such loophole exists.

2 hours agoProgressive groups across the country are at odds with a decision made by Sen. 1 day agoPresident Trump campaigned against the carried interest loophole in 2016 and in his otherwise regressive 2017 tax law he imposed the three-year holding requirement that Congress now wants to. Many politicians want to close the carried interest tax loophole for private equity managers.

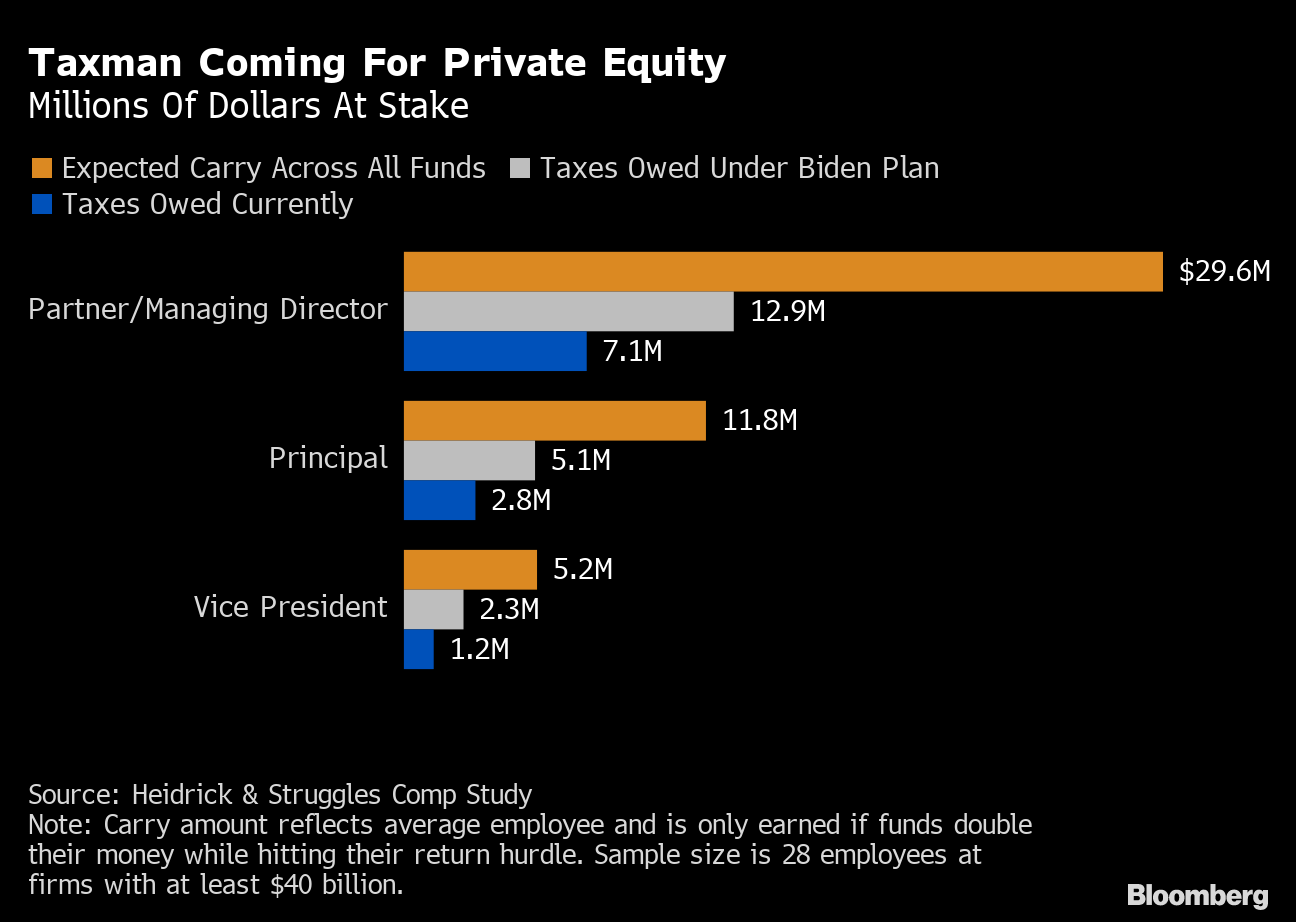

2 days agoThe carried interest tax loophole allows private equity firms hedge funds and their investors to tax income from investments as capital gains which top out at 20. It does not help small businesses pension funds other investors in hedge funds or private equity and everyone in the industry knows it. The carried interest tax loophole is an income tax avoidance scheme that allows private equity and hedge fund executives some of the richest people in the world to substantially lower the amount they pay in taxes.

The carried interest loophole is a stain on the tax code. Closing the carried interest loophole is likely to be one of the thorniest sticking points in moving the Inflation Reduction Act of 2022 forward. The carried interest loophole allows private equity barons to claim large parts of their compensation for services as.

Carried interest is a share of the profits that private equity or hedge fund managers take as compensation. The provision is unpopular. Politico and Axios reported that Sinema wants to nix a Democratic measure to narrow the carried interest tax loophole and add 5 billion in drought resiliency into the package.

Free Online Tax Tutorial - Tax Consultant Certification - Be Certified Tax Consultant 100. The change would require these. The carried interest loophole allows hedge fund managers to tax their income at a lower rate than an ordinary salary.

Ad Become Certified Tax Consultant Quickly - Tax Consulting Learning Free Updated 2022. The rest of the tax hikes are on corporations. July 15 2016.

It does not help small businesses pension funds other investors in hedge funds or. Carried interest essentially lets investors especially private equity managers pay a lower tax rate on their income. Senate Majority Leader Charles Schumer and Sen.

The carried-interest loophole is a blatant giveaway to the super-rich. Thats because when they invest in a company they may receive their cut of. The carried interest tax loophole is the poster child for the corrupting influence of money in politics.

Tax code that allows some of the wealthiest people in the country the managers of private-equity. Kyrsten Sinema D-Ariz to remove the carried interest tax loophole from a social spending and tax bill that is expected to pass through the Senate claiming she is providing a tax break for the wealthy.

Loopholes 101 Carried Interest Loophole Patriotic Millionaires University

Debunking Fiscal Myths There Is No Loophole For Carried Interest

Debunking Fiscal Myths There Is No Loophole For Carried Interest Cato At Liberty Blog

Zeonzecl On Twitter The Borrowers Things To Come Handouts

Fund Managers Thoughts On The Carried Interest Tax Loophole

You Want To Know A Really Dirty Secret Here S Why Democrats Are Protecting Private Equity S Carried Interest Loophole

Beyond The Carried Interest Tax Loophole Occasional Links Commentary

Loopholes 101 Carried Interest Loophole Patriotic Millionaires University

How Does Carried Interest Work Napkin Finance

How Does Carried Interest Work Napkin Finance

Carried Interest Tax Private Equity Billionaires Angry Over Closing Loophole Bloomberg

Carried Interest Calculation Tax Loophole Understanding Pe Vc Youtube